IMMEDIATE RELEASE

May 23, 2024

New Construction in Martin County Adds $790 Million Market Value to Tax Roll

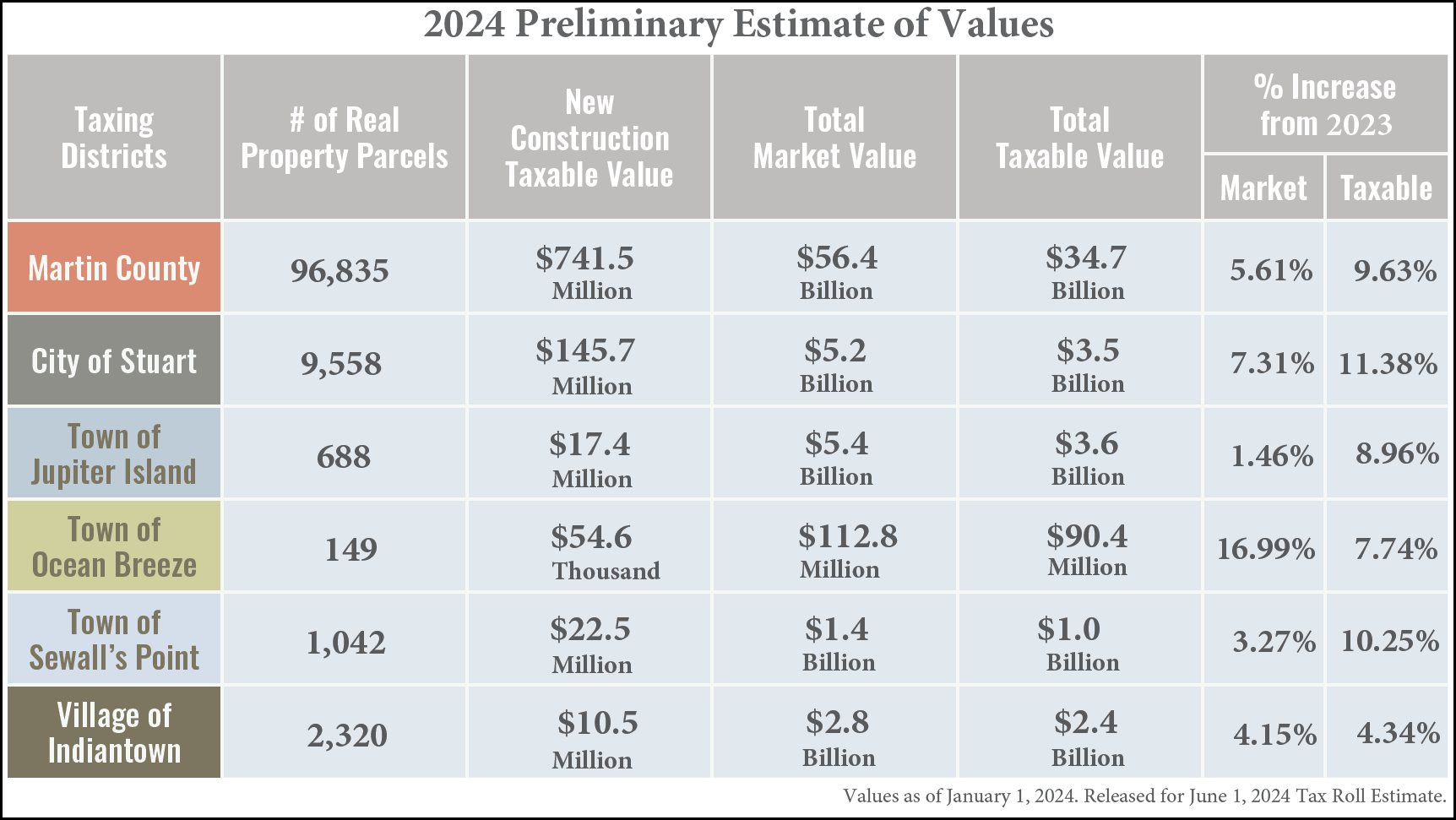

Stuart, FL - The Martin County Property Appraiser’s Office released the 2024 estimated preliminary taxable values to the ten Martin County Taxing Authorities yesterday. The Taxing Authorities will use the estimated taxable values to prepare their upcoming budgets and determine their proposed millage rates.

The numbers show that Martin County taxable values are at $34.7 billion, an increase of 9.63% compared to last year’s number of more than $31.6 billion.

The total growth in market value increased by 5.61% to $56.4 billion, compared to last year’s value of more than $53.4 billion. This includes the appreciation in values based on market data along with increases from new construction of residential, commercial, & industrial buildings.

Property Appraiser Jenny Fields, CFA – “This year, Taxing Authorities are benefiting from Florida’s unique assessment limitation laws by receiving a taxable value percent increase that exceeds the market value percent increase for the year. This is a result of assessment caps continuing to increase until they eventually catch up with multiple years of fast market value growth. This is known as “assessment recapture” and is driven primarily by non-homesteaded properties that have a 10% assessment limitation each year.”

Industrial properties showed continued strength based on 2023 market data and the amount of new construction that was substantially complete on or before January 1st, 2024. Preliminary estimates show the total growth in market value for the sector at slightly above 19%. Half of this growth is from market value appreciation while the other half of the growth is coming from new construction and additions which equal approximately $92.7 million. This is a result of adding more than 30 new industrial buildings and units to the current tax roll which results in over 1.1 million square feet of new industrial space. Included in this total is the new Gateway Distribution Center facilities accounting for approximately 1 million square feet.

The 2023 preliminary estimate shows a market value increase in residential properties of 5.34%. This includes vacant residential land, single family homes, single family townhomes, mobile homes, residential condominiums, and multi-family properties. Early new construction estimates show a total of $790 million in market value added from new buildings and additions. Residential new construction accounted for $650 million or 82% of the total new construction of all real estate county wide.

A deeper look into residential new construction activity shows an early estimate of 542 single family homes and townhomes built in 2023. Local communities with the highest homebuilding activity are Canopy Creek, Highpointe, Bridgewater Preserve, Banyan Bay, and Sabal Pointe. Single family homes and townhomes currently account for $450 million with an average new construction value of $831,000 per home.

Included in this year’s current new construction estimate are 6 new multi family projects with a total of 1,159 apartment units added. These projects account for $132 million in new construction and are the River North, Indigo Stuart, Reserve at Jensen Beach, Farrell Communities Central Parkway, Mason Stuart, & Seminole Junction Apartments.

The ten Martin County Taxing Authorities are the Children’s Service Council, the City of Stuart, the Florida Inland Navigation District, Martin County Board of County Commissioners, the Martin County School Board, the South Florida Water Management District, the Town of Jupiter Island, the Town of Sewall’s Point, the Town of Ocean Breeze and the Village of Indiantown.

These estimated preliminary taxable and market values are based on market conditions as of January 1, 2024.

Property Appraiser Jenny Fields and her office professionals will next certify the 2024 Preliminary Tax Roll to the Florida Department of Revenue before the July 1 deadline.

For more information or to schedule an interview with Martin County Property Appraiser Jenny Fields, please email